ESG platforms have become increasingly popular in recent years as companies work to address consumer and investor concerns about environmental, social, and governance (ESG) issues. These platforms provide a software-as-a-service (SaaS) tool that collects data and streamlines an organization's ESG program. They use various metrics to calculate impacts, create reports, unlock data for analysis, and provide actionable insights.

An ESG platform includes various features that funnel data sets into a single system, allowing companies to manage their ESG initiatives better. Some of the features include sustainability reporting and analytics capabilities, a data model, technical support, and unlimited 24/7 access. By using an ESG platform, organizations can simplify data collection, benchmarking, and reporting with an auditable ESG platform that scales with them. They can map their ESG data against a variety of standards, including SASB, GRI, TCFD, CDP, and WEF. Using the platform, they can also easily pull ESG data from systems of record, surveys, and spreadsheets across their organization.

ESG platforms are becoming increasingly important as companies strive to become more sustainable and socially responsible. With the rise of net-zero targets and increased scrutiny from consumers, business partners, and regulators, having a trusted platform for emissions and carbon credit traceability through tokenization is essential. ESG platforms provide a way for companies to tell their organization's ESG story on a digitally trusted platform, promoting transparency and accountability. As the world becomes more focused on sustainability, ESG platforms will continue to play a critical role in helping companies achieve their ESG goals.

ESG Platform Overview

What is an ESG platform?

An ESG platform is a software solution that helps organizations manage, report, and analyze their Environmental, Social, and Governance (ESG) data. ESG platforms provide a comprehensive approach to ESG management, incorporating data from a range of sources, including internal operations, supply chains, and third-party data providers. They enable companies to track and report on their progress towards ESG goals and provide actionable insights to help improve performance.

Why are ESG platforms important?

ESG platforms are important because they help organizations manage and mitigate ESG risks, improve transparency, and meet reporting requirements. ESG risks can significantly impact a company's reputation, financial performance, and long-term sustainability. By using an ESG platform, companies can identify and manage these risks and demonstrate their commitment to sustainability to investors, customers, and other stakeholders.

Who uses ESG platforms?

ESG platforms are used by a range of stakeholders, including ERM (Enterprise Risk Management) professionals, sustainability managers, and investors. ERM professionals use ESG platforms to identify and manage ESG risks, while sustainability managers use them to track progress toward ESG goals and report on performance. Investors use ESG platforms to evaluate companies' ESG performance and make informed investment decisions.

ESG platforms are designed to be user-friendly and accessible to a range of stakeholders. They often include API (Application Programming Interface) integrations with other software solutions, such as reporting frameworks and security tools, to provide a comprehensive approach to ESG management.

Overall, ESG platforms provide a comprehensive, data-driven approach to ESG management, helping organizations improve transparency, meet reporting requirements, and achieve their sustainability goals. By providing actionable insights and metrics, ESG platforms enable companies to take a more proactive approach to sustainability and work towards a net-zero future.

ESG Platform Features

ESG platforms are digital solutions that help companies manage their environmental, social, and governance (ESG) risks and opportunities. These platforms offer a range of features that help companies collect, analyze, report, and act on ESG data. This section explores some of the key features of ESG platforms.

Data Collection

One of the most important features of ESG platforms is their ability to collect data from various sources. ESG platforms can gather data from internal systems, external databases, and third-party providers. They can also collect data from surveys, questionnaires, and other sources of stakeholder feedback. ESG platforms use advanced analytics to process this data and provide insights into ESG risks and opportunities.

Inclusion & Materiality Assessments

ESG platforms also help companies assess the materiality of ESG risks and opportunities. Materiality assessments help companies identify the ESG issues that are most relevant to their business and stakeholders. ESG platforms can also help companies assess the inclusion of ESG factors in their decision-making processes. This includes evaluating the integration of ESG factors into investment decisions, risk management, and strategy development.

Scalability & Assurance

ESG platforms are designed to be scalable and flexible. They can handle large volumes of data and support multiple users across different departments and locations. ESG platforms also provide assurance and validation of ESG data. This includes data quality checks, audit trails, and other features that help ensure the accuracy and reliability of ESG data.

Consulting & Transactions

ESG platforms can also provide consulting services to help companies develop and implement ESG programs. This includes advising companies on ESG strategy, governance, and reporting. ESG platforms can also facilitate ESG transactions, such as green bonds and sustainability-linked loans. This includes providing data and analytics to support these transactions and ensuring compliance with ESG standards and guidelines.

ESG platforms can help companies manage a wide range of ESG issues, including health, safety, suppliers, customers, climate change, regulation, equity, employees, accountability, social issues, leadership, diversity, workflows, tax, DEI, board diversity, nature, corporate governance, corporate sustainability, philanthropy, ESG scores, capital markets, decarbonization, renewable energy, data privacy, human rights, anti-corruption, global compact, workforce, guidelines, labor standards, ESG metrics, ESG rating agencies, investment decisions, data providers, software solutions, and ESG platforms.

Choosing an ESG Platform

When it comes to choosing an ESG platform, there are a number of key considerations to keep in mind. These platforms can help organizations collect and analyze data related to environmental, social, and governance factors, which can be critical for making informed business decisions. Here are some things to keep in mind when choosing an ESG platform.

Key Considerations

- Data Collection and Analysis: One of the most important considerations when choosing an ESG platform is the ability to collect and analyze data. Look for a platform that can handle both structured and unstructured data and that can provide insights into key ESG factors.

- Reporting and Disclosure: The platform should also be able to generate reports and disclosures that comply with relevant regulations and standards. Look for a platform that can automate reporting processes and generate reports in a variety of formats.

- Integration with Other Systems: The platform should be able to integrate with other systems and tools used by the organization, such as accounting software or supply chain management tools.

- Ease of Use: The platform should be user-friendly and easy to navigate, with clear instructions and support available when needed.

- Scalability: The platform should be able to scale with the organization as it grows and its ESG reporting needs become more complex.

Top ESG Platforms

Here are some of the top ESG platforms currently available:

| Platform | Key Features |

|---|---|

| Deloitte ESG Platform | Data collection and analysis, reporting and disclosure, integration with other systems, customizable dashboards |

| Sustainalytics | Data collection and analysis, reporting and disclosure, customizable dashboards, integration with other systems |

| Truvalue Labs | Real-time ESG data collection and analysis, AI-powered insights, integration with other systems, customizable dashboards |

| MSCI ESG Research | Data collection and analysis, reporting and disclosure, integration with other systems, customizable dashboards |

| Bloomberg ESG | Data collection and analysis, reporting and disclosure, customizable dashboards, integration with other systems |

| Polyuno ESG | Polyuno offers comprehensive ESG solutions that streamline reporting, enhance sustainability practices, and empower organizations to make informed decisions aligned with their environmental, social, and governance goals. |

These platforms offer a range of features and capabilities, so it's essential to carefully evaluate each to determine the best fit for your organization's needs.

Best Practices for ESG Platform Implementation

Implementing an ESG platform can be a daunting task for any organization. However, there are best practices that can make the process smoother and more effective. This section will discuss three key areas to focus on when implementing an ESG platform: Setting Goals & Metrics, Engaging Stakeholders, and Ensuring Data Quality.

Setting Goals & Metrics

Before implementing an ESG platform, it is important to establish clear goals and metrics. This will help ensure that the platform is aligned with the organization's overall ESG strategy. The following are some best practices for setting goals and metrics:

- Identify the key ESG issues that are most relevant to the organization. This could include health and safety, diversity, sustainability, and more.

- Set specific, measurable goals for each ESG issue. For example, if the organization is focused on sustainability, it could set a goal to reduce its carbon footprint by a certain percentage.

- Establish metrics to track progress towards each goal. This could include both quantitative metrics (such as carbon emissions) and qualitative metrics (such as employee satisfaction).

Engaging Stakeholders

Engaging stakeholders is critical to the success of any ESG platform implementation. This includes both internal stakeholders (such as employees and executives) and external stakeholders (such as customers and investors). The following are some best practices for engaging stakeholders:

- Communicate the organization's ESG goals and strategy clearly and consistently.

- Solicit feedback from stakeholders to ensure that their concerns and priorities are being addressed.

- Encourage stakeholders to participate in the ESG platform by providing them with access to relevant data and information.

Ensuring Data Quality

Ensuring data quality is essential to the effectiveness of an ESG platform. This includes both the accuracy and completeness of the data being collected. The following are some best practices for ensuring data quality:

- Establish transparent data collection processes and procedures.

- Regularly review and audit the data being collected to ensure its accuracy and completeness.

- Use technology and automation to help streamline data collection and analysis.

By following these best practices, organizations can successfully implement an ESG platform that is aligned with their overall ESG strategy and goals.

ESG Services from Polyuno

Polyuno is a provider of ESG reporting and materiality services that help clients effectively communicate their ESG performance to stakeholders and identify the most important ESG issues to their business. They offer a range of services to help clients meet their ESG goals, including:

ESG Reporting

Polyuno provides ESG reporting services that help clients meet the reporting requirements of their stakeholders, regulators, and investors. They help clients collect, analyze, and report on ESG data to communicate their ESG performance to stakeholders. They use a variety of tools and technologies to help clients automate their ESG reporting processes and make their reporting more efficient.

ESG Materiality

Polyuno provides ESG materiality services that help clients identify the most important ESG issues to their business. They work with clients to assess their ESG risks and opportunities and identify the ESG issues that are most material to their business. They help clients prioritize their ESG issues and develop strategies to address them.

ESG Strategy

Polyuno provides ESG strategy services that help clients develop and implement ESG strategies that align with their business goals and values. They work with clients to develop ESG policies, goals, and targets and help them integrate ESG considerations into their business operations. They guide how to engage with stakeholders on ESG issues and measure and report on ESG performance.

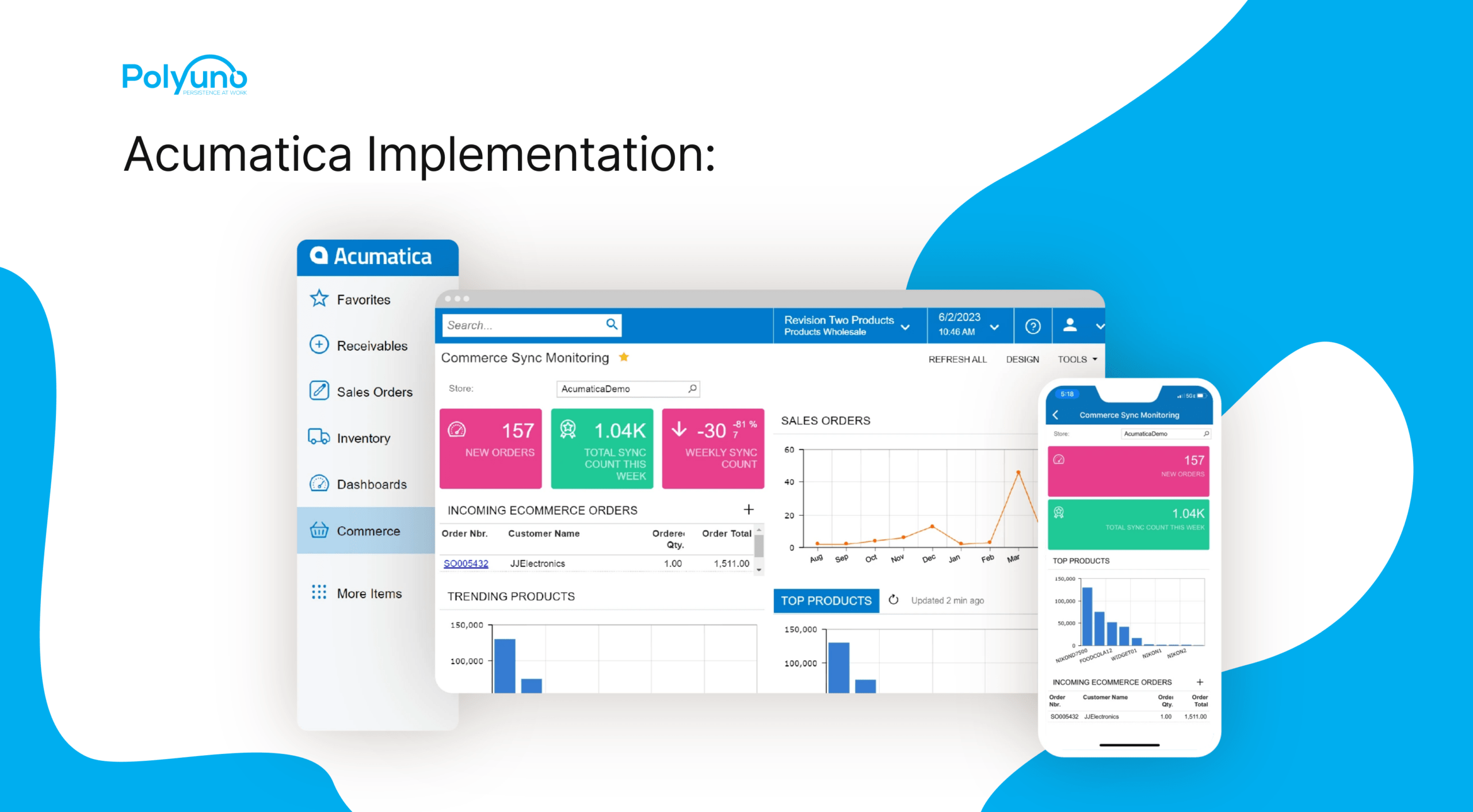

ESG Technology

Polyuno provides ESG technology services that help clients measure, report, and gain deeper insights into their ESG performance. They have developed digital tools and accelerators to help clients deliver efficient, reliable, impactful, and sustainable ESG outcomes. Their human-led, tech-powered approach helps clients act in all stages of their ESG path, from net-zero and decarbonization strategies to ESG reporting and materiality.

Polyuno's ESG services help clients meet their ESG goals and communicate their ESG performance to stakeholders. They provide a range of services that help clients identify the most critical ESG issues to their business, develop and implement ESG strategies, and measure and report on ESG performance.