ESG data reporting has become an increasingly important topic for companies across various industries. ESG stands for Environmental, Social, and Governance and refers to the three main factors used to measure the sustainability and ethical impact of a company's operations. As investors and consumers become more aware of companies' impact on the environment and society, there is growing demand for transparency and accountability in ESG reporting.

One of the biggest challenges companies face regarding ESG reporting is data collection and management. Companies can use numerous frameworks and standards to report on their ESG performance, but collecting accurate and reliable data can be a complex and time-consuming process. Companies need to collect data not only on their own operations but also on their suppliers and other stakeholders. This requires a comprehensive data management strategy that can handle large amounts of data from multiple sources and ensure its accuracy and completeness.

ESG Reporting: An Overview

ESG reporting refers to the disclosure of a company's environmental, social, and governance (ESG) data. The disclosure of ESG data is becoming increasingly important for investors, stakeholders, and regulators. ESG reporting provides a comprehensive view of a company's performance on issues such as diversity, climate-related risks, greenhouse gas emissions, safety, human rights, and environmental sustainability.

ESG reporting is more than just a regulatory requirement. It is a business imperative that can help companies build trust with their stakeholders, enhance their value proposition, and make more informed investment decisions. ESG data collection and reporting can also help companies identify trade-offs and make more sustainable decisions that balance financial, social, and environmental considerations.

ESG reporting frameworks such as the Global Reporting Initiative (GRI) provide a standardized methodology for companies to report on their ESG performance. These frameworks help companies ensure that their ESG data is accurate, transparent, and comparable over time.

Regulatory requirements around ESG reporting are also evolving. For example, the US Securities and Exchange Commission (SEC) has proposed new rules for climate disclosures that focus on the oversight of climate-related risks. Compliance with these regulations is becoming increasingly important for companies to avoid accusations of greenwashing and maintain the trust of their customers, investors, and other stakeholders.

ESG reporting is not just relevant to large corporations. Small and medium-sized enterprises (SMEs) are also increasingly expected to report on their ESG performance. ESG reporting can help SMEs identify opportunities to improve their sustainability practices, enhance their reputation, and attract talent and customers who value corporate social responsibility (CSR).

In summary, ESG reporting is critical for companies to demonstrate their commitment to sustainability, transparency, and accountability. It is important for companies to collect accurate ESG data, report it transparently, and use it to inform their decision-making. ESG reporting is a regulatory requirement and a business imperative that can help companies build trust, enhance their value proposition, and make more informed investment decisions.

The Importance of Accurate ESG Data Reporting

Accurate ESG data reporting is crucial for companies that want to build trust with investors, stakeholders, and regulators. Without accurate data, assessing the true value of a company's ESG performance is difficult, and unreliable reporting can expose companies to financial, regulatory, and reputational risks.

Transparency is essential in ESG reporting, and investors and stakeholders need to be able to trust the data that companies provide. Accurate reporting allows investors to make informed decisions about which companies to invest in, and it also helps companies to identify areas where they can improve their ESG performance.

ESG reporting is becoming increasingly important as climate risks, and carbon emissions come under greater scrutiny. Companies that accurately report their ESG data are better equipped to manage these risks and reduce their carbon footprint. Accurate reporting also helps to prevent greenwashing, which is the practice of making false or exaggerated claims about a company's sustainability efforts.

To ensure the accuracy of ESG reporting, companies need to have a transparent methodology for collecting and reporting data. This methodology should be validated by an independent third party to ensure that the data is reliable and trustworthy. Companies also need to be transparent about any trade-offs that they make between different ESG goals.

In conclusion, accurate ESG data reporting is essential for companies that want to build trust with investors, stakeholders, and regulators. It allows companies to make informed decisions about their ESG performance, manage climate risks, and reduce their carbon footprint. By providing reliable and transparent data, companies can demonstrate their commitment to sustainability and positively impact the world.

Regulatory Requirements for ESG Data Reporting

ESG data reporting has gained significant importance in recent years, and companies are increasingly expected to disclose their ESG data to their stakeholders. Regulatory bodies around the world are implementing new rules and requirements to ensure that companies report their ESG data accurately and transparently.

In the United States, the Securities and Exchange Commission (SEC) has introduced new rules requiring companies to disclose climate-related risks and other ESG factors in their public filings. The rules require companies to disclose their ESG data using a standardized reporting framework.

The Global Reporting Initiative (GRI) is one such framework that companies can use to report their ESG data. The GRI provides a comprehensive set of guidelines for companies to report their ESG data, including carbon emissions and greenhouse gas emissions.

Companies are also expected to report on their sustainability and corporate social responsibility (CSR) efforts. This includes reporting on their efforts to address climate change and environmental sustainability.

Transparency is a key element of ESG reporting, and companies are expected to disclose their ESG data in a clear and understandable manner. This includes providing context for their ESG data and explaining how they are addressing ESG risks and opportunities.

In addition to regulatory requirements, companies also face pressure from investors and other stakeholders to report their ESG data. This has led to a growing trend of voluntary ESG reporting, with many companies choosing to disclose their ESG data even when regulators do not require it.

Overall, regulatory requirements for ESG data reporting are becoming more stringent, and companies must ensure that they are meeting these requirements. By reporting their ESG data accurately and transparently, companies can build trust with their stakeholders and demonstrate their commitment to sustainability and responsible business practices.

ESG Reporting Frameworks and Standards

ESG reporting has become increasingly important for investors, customers, and other stakeholders who want to understand a company's sustainability practices. To meet the growing demand for ESG data, several reporting frameworks and standards have emerged in recent years. These frameworks provide guidance on how companies should report their ESG data and ensure the data is accurate, transparent, and consistent.

One of the most widely used ESG reporting frameworks is the Global Reporting Initiative (GRI). The GRI provides a comprehensive reporting framework that covers a wide range of sustainability issues, including climate risks, carbon emissions, and environmental sustainability. The GRI's reporting methodology is based on a set of principles that emphasize the importance of materiality, stakeholder engagement, and transparency.

Another reporting framework that has recently gained popularity is the Sustainability Accounting Standards Board (SASB). The SASB focuses on material sustainability issues that are relevant to specific industries. The SASB's reporting framework is designed to provide investors with the information they need to make informed investment decisions.

In addition to these reporting frameworks, companies can use several ESG standards to ensure their ESG data is valid and reliable. For example, the ISO 14001 standard provides a framework for environmental management systems, while the ISO 26000 standard provides corporate social responsibility (CSR) guidance.

Overall, the use of ESG reporting frameworks and standards is essential for companies that want to demonstrate their commitment to sustainability and transparency. Companies can use these frameworks to ensure their ESG data is accurate, consistent, and relevant to stakeholders.

The Role of Technology in ESG Data Reporting

ESG data reporting is becoming increasingly important for companies and investors alike. As sustainability and social responsibility become more critical factors in decision-making, ESG data reporting is essential for accurate and reliable information. Technology plays a significant role in this process, making it easier for companies to collect, analyze, and report ESG data accurately.

Using software to collect and analyze ESG data can help companies provide stakeholders with reliable and accurate information. This information can be used to measure ESG performance, identify areas of improvement, and make informed decisions. In addition, technology can help companies identify climate risks, track carbon emissions, and improve sustainability.

Investors are also looking for reliable ESG data to make informed decisions. Technology can help companies provide this information, making it easier for investors to assess the value of investments. ESG data reporting can also help companies demonstrate their commitment to sustainability and social responsibility, which can attract investors who value these qualities.

Using technology to extract ESG data is bigger than just sustainability. It can unlock value and help companies improve their overall performance. Building a methodology for collecting and reporting ESG data is essential for achieving that level of ESG data transparency. Technology solutions should support both short and long-term ESG reporting strategies.

Valid and reliable ESG data reporting can help companies demonstrate their commitment to sustainability and social responsibility. It can also help investors make informed decisions and identify companies that align with their values. By using technology to collect, analyze, and report ESG data, companies can improve their overall performance and provide stakeholders with accurate and reliable information.

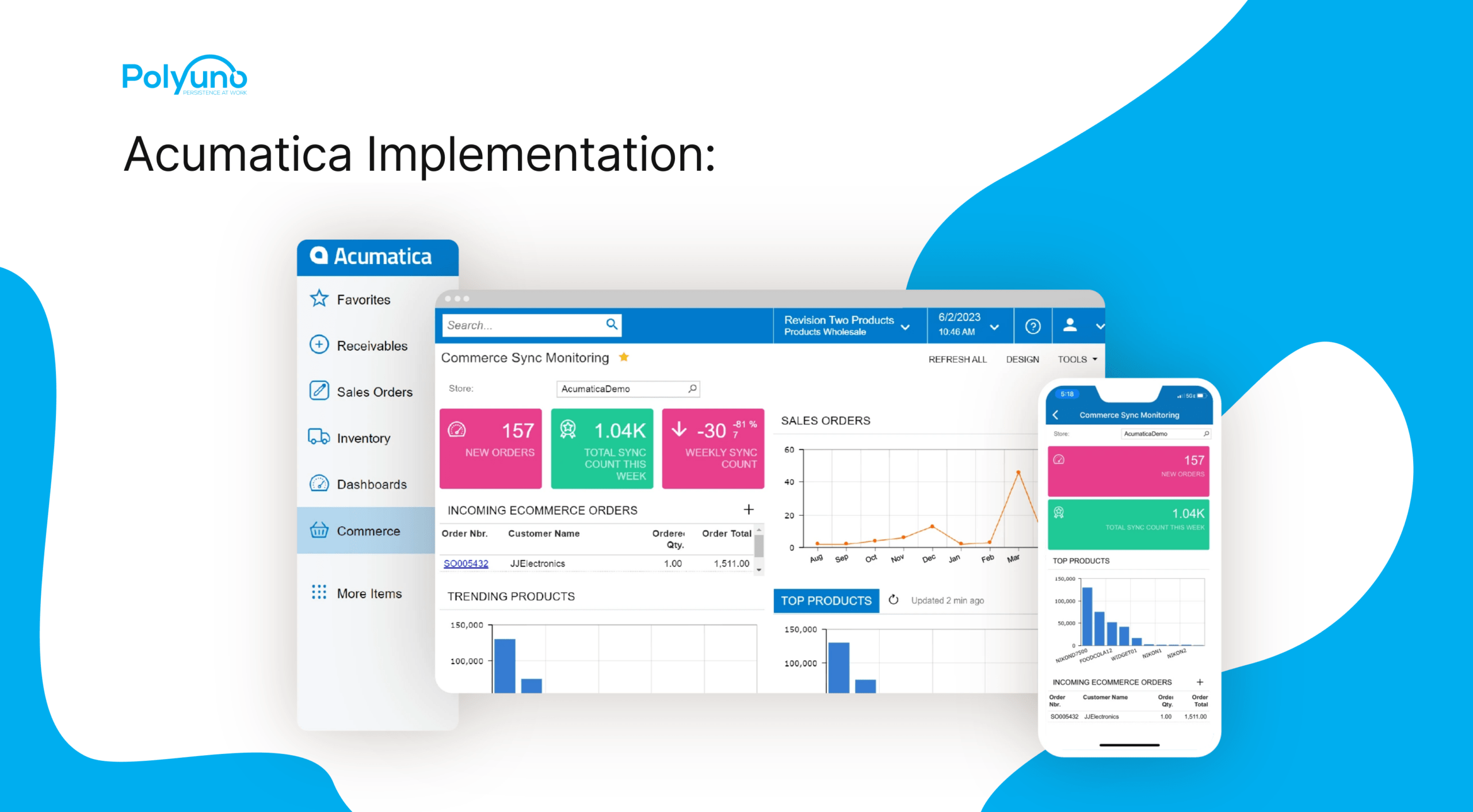

ESG Reporting Services from Polyuno

Polyuno is a leading provider of ESG reporting and materiality services that help clients meet the growing demand for ESG disclosure from investors, regulators, and other stakeholders. Polyuno's ESG reporting services are designed to provide transparent and accurate information about a company's ESG performance, which can help build trust and credibility with stakeholders and improve overall sustainability performance.

Polyuno's ESG reporting services include:

ESG Data Collection and Management

Polyuno can help clients collect, manage, and report on their ESG data using tools and platforms that enable data-driven decision-making and ESG performance monitoring. Polyuno's team of experts can assist with the identification and collection of ESG data, as well as the development of data management processes and controls to ensure data accuracy and reliability.

ESG Performance Reporting

Polyuno can help clients report on their ESG performance in a transparent, accurate way, and in line with industry standards and best practices. Polyuno's ESG performance reporting services include the development of ESG reports, sustainability reports, and other ESG disclosures that provide stakeholders with a clear understanding of a company's ESG performance.

ESG Materiality Assessment

Polyuno can help clients identify the most critical ESG issues to their business and stakeholders through a materiality assessment. Polyuno's materiality assessment services provide clients with a comprehensive understanding of the ESG issues that are most relevant to their business and guidance on how to prioritize and address these issues.

ESG Strategy Development

Polyuno can provide guidance on how to develop and implement an ESG strategy that aligns with a company's business objectives and stakeholder expectations. Polyuno's ESG strategy development services include identifying ESG risks and opportunities, developing ESG goals and targets, and implementing ESG initiatives to achieve these goals.

Overall, Polyuno's ESG reporting and materiality services are designed to help clients effectively communicate their ESG performance to stakeholders and identify the most critical ESG issues to their business. Polyuno's team of experts can assist with all aspects of ESG reporting and materiality, from data collection and management to strategy development and implementation.